It’s widely known that tax payment may affect social credit. But there are always some people forgetting to do such things and finally not allowed to leave China. Let’s check what’s wrong.

Many people have registered a company for many reasons but didn’t run it so that there’s no income. Therefore, they forget to file tax returns.

Obviously, such an act violates relevant laws and regulations.

China’s State Taxation Administration (STA) has established a modern tax credit rating system.

Taxpayers will be rated at five different levels (A, B, M, C, D) based on the evaluation results.

A-level taxpayers are entitled to more favorable treatments and D-level taxpayers are subjected to stricter scrutiny in a wide range of tax-related matters such as application for invoice issuance and VAT refunds on exported goods.

A company will be forced to be deregistered with no tax return for accumulative 6 months. Such a result strongly impacts taxpayer’s credit.

According to the Measures for Tax Credit Administration (for Trial Implementation), a taxpayer cannot be rated A-level in the evaluation year if he or she has not filed tax returns for accumulative 6 months.

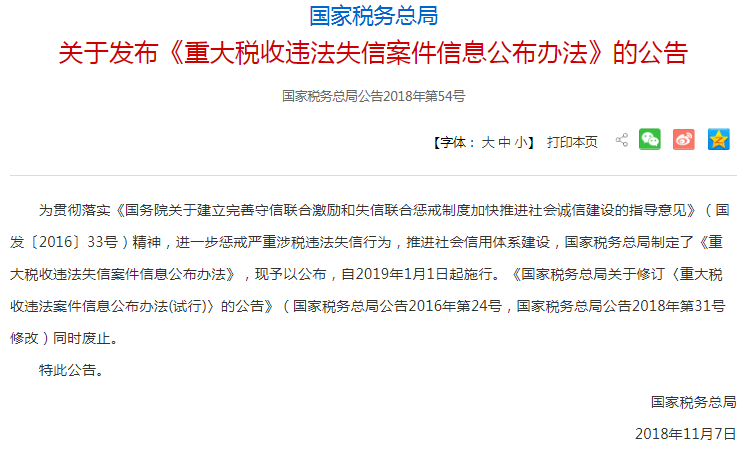

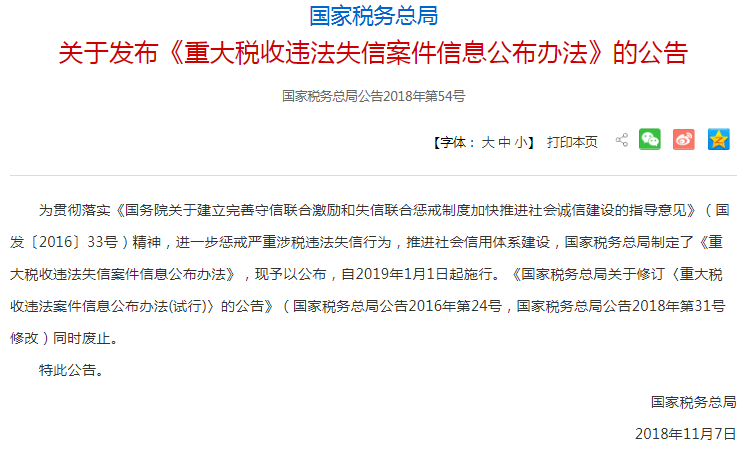

What’s more, STA has implemented the Measures for the Disclosure of Information on Major Cases of Tax-Related Illegal and Unfaithful Acts from Jan 1, 2019.

If the case is identified as a “major case of tax-related illegal and unfaithful acts”, the taxpayer will be directly rated D-level, and his or her exit will be strictly restricted.

In short, if you don’t take tax-return seriously, you are probably not allowed to leave China, even there’s no taxable income.

So please remember to do account and file tax return, or cancel the company’s registration in a timely manner.

Briefly, a taxpayer who violate the relevant laws and regulations, trying to cheat in taxation or maliciously owe taxes, will be rated D-level directly.

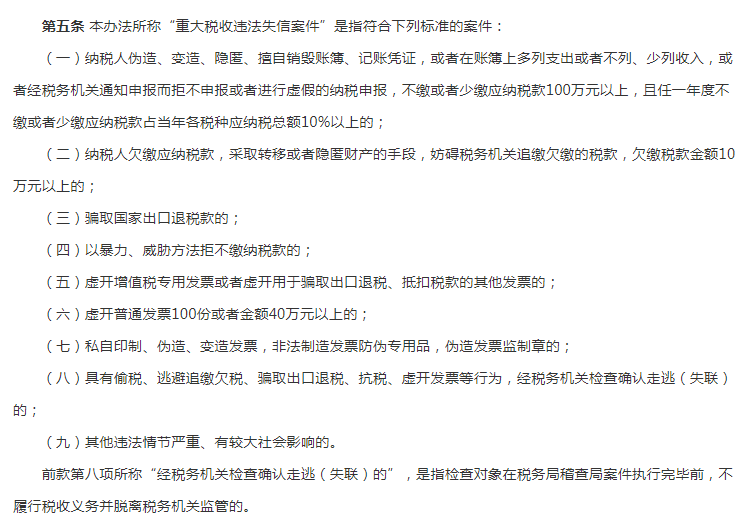

According to the Measures, a “major case of tax-related illegal and unfaithful acts” means a case meeting any of the following standards:

-

A taxpayer forges, alters, conceals or destroys without authorization any accounting book or bookkeeping voucher, or overstates expenses or fails to state or understates income in the accounting book, or refuses to file tax returns after having been notified by the tax authority or files fraudulent tax returns, or fails to pay or underpays the taxes payable by more than 1 million yuan, with the amount of taxes payable that are not paid or underpaid in any year accounting for more than 10% of the total of various taxes payable in that year.

-

A taxpayer fails to pay the tax arrears, or hinders the tax authority from recovering the tax arrears by means of transferring or concealing its property, with the amount of tax arrears by more than 100, 000 yuan.

-

Anyone fraudulently obtains any export tax refund from the state.

-

Anyone refuses to pay taxes by means of violence or menace.

-

Anyone forges VAT special fapiao or forges other fapiao for tax-refund fraud or tax-deduction fraud.

-

Anyone forges 100 pieces of ordinary fapiao or in total value of over 400,000 yuan.

-

Anyone privately prints, forges or alters fapiao, illegally produces security products of fapiao.

-

Anyone with tax dodging, tax evasion or tax fraud, is confirmed escaping.

-

Other illegal acts with severe social impact.

△ Article 5 of the Measures for the Disclosure of Information on Major Cases of Tax-Related Illegal and Unfaithful Acts

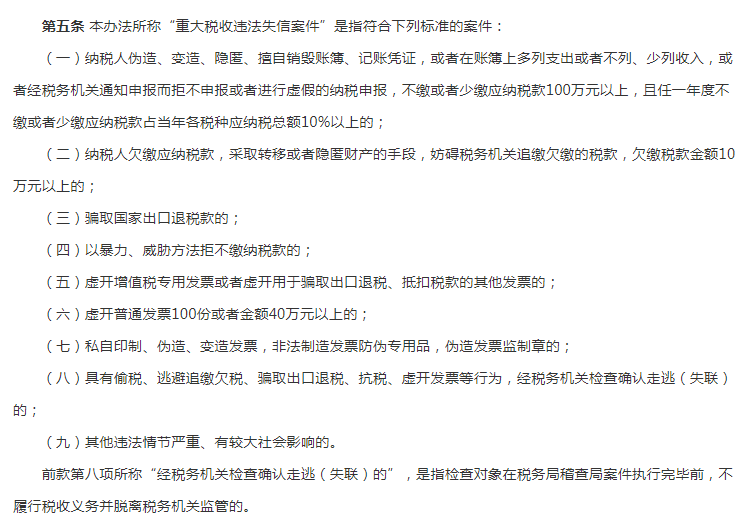

WHICH ACTS IMPACT RATING?

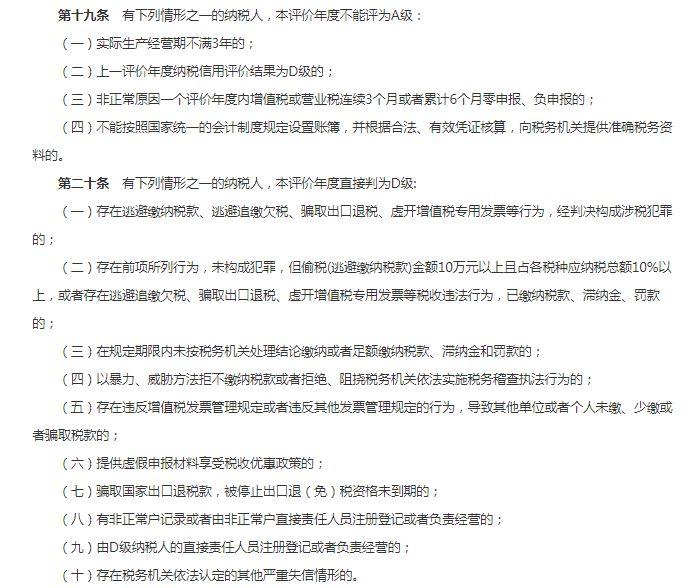

A taxpayer cannot be rated A-level in the evaluation year when meeting any of the following conditions:

-

Actual operation period is not more than 3 years;

-

Last year’s tax credit rating result is D-level;

-

Taxpayer has not filed VAT or CIT return for consecutive 3 months or accumulative 6 months with irregular reasons;

-

Company has not established account books that meet the supervisory requirements, and has not provided legal, valid and accurate documents.

If the actual condition is worse than what’s mentioned above, then the taxpayer may be rated D-level.

△ Article 19 & Article 20 of the Measures for Tax Credit Administration (for Trial Implementation)

As we’ve said a thousand times, China is making changes to the local business environment, in order to make it “fair, transparent and predictable”.

To close the goal, the government authorities have issued a series of policies and measures to push forward the establishment of the Social Credit System (SCS).

As part of the system, it is believed that the tax credit rating system will be continuously improved and stricter.

If you have any problem with taxation and operation, please contact us. We will help you.

Share to let your friends know!