Foreigners who live and work in mainland China for prolonged periods will be required to pay tax on worldwide income under a new law that took effect on Tuesday. But while the new regulations might at first seem punishing, Beijing has left plenty of room for non-natives to avoid the extra payments.

© Image | Google

Difference between a resident

and non-resident taxpayer

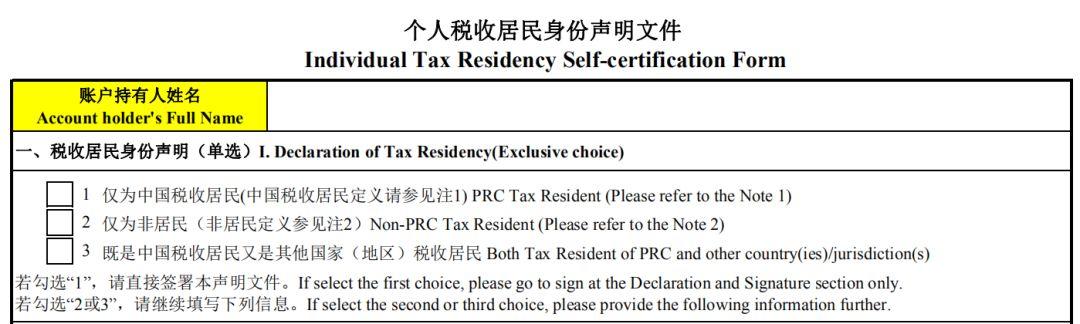

Approved at the end of August, the new legislation defines a “resident taxpayer” as anyone who is either domiciled in mainland China, or non-domiciled but spends 183 days or more over the course of a calendar year.

Previously, foreigners – a term that includes residents of Hong Kong, Taiwan and Macau – had to spend more than 12 months in the country before being classed as a resident for tax purposes.

© Image | Scmp

The difference between a resident and non-resident taxpayer is that the former is liable to pay tax on their global income, not just the money they make in China.

But it is not all bad news for foreigners working in the world’s most populous country, as with the new tax law comes an improved exemption to it.

New Rule! Foreigners Can Avoid to Be Chinese Resident Taxpayers!

New Rule! Foreigners Can Avoid to Be Chinese Resident Taxpayers!

Difference between now and before

According to a notice published by the State Administration of Taxation last month, resident taxpayers who spend more than 30 consecutive days outside China in any given six-year period are exempt from having to declare their global earnings.

In the past, they had to leave the country for 30 days or more every five years to gain the exemption, so the revision gives them 20 per cent more time to meet the obligation.

Your Residence Permit in China Affected by This Form?!

Your Residence Permit in China Affected by This Form?!

Questions raised about

new 183-day rule

However, Louis Lam, a tax partner at PwC Global Mobility Services, said that under the original law, as well as the option of the 30-day sojourn, taxpayers could avoid having to declare their worldwide income by taking shorter breaks, as long as they spent at least 90 days a year outside the country.

That second option appeared to have been omitted from the revised legislation, which could cause problems for workers who were unable to take extended breaks away from the mainland, he said, but added there was still the chance it would be reinstated or clarified in a subsequent notice from the tax authority.

When the new 183-day rule was announced in the summer, some observers said it went against Beijing’s efforts to attract overseas talent – including Hongkongers on relatively short-term contracts – to work in the mainland.

© Image | Google

Others said it was also unclear how the revised legislation would be applied – including exactly when the 183-day and six-year clocks start ticking – and if it would negate agreements already in place to prevent workers being taxed twice on the same earnings.

Exemption no longer

applies to these groups

For instance, Beijing and Hong Kong have an agreement that allows people to work on either side of the border but pay tax only to the relevant authorities at home – a term loosely defined as where their main residence and family are.

Under the new rule, that exemption no longer applies to certain groups, including:

-

Hong Kong residents that have a permanent home and family on the mainland,

-

Unmarried Hongkongers who work on the mainland and do not own a flat in their home city,

-

Hong Kong retirees living on the mainland,

-

Mainlanders who work but do not live in Hong Kong.

As for bonus payments and equity incentives, the tax authority said last week that it would exclude these from the new tax rules for a further three years.