China is set to introduce a range of new allowances that could save taxpayers tens of thousands of yuan a year. It’s worth mentioning, the new allowance are not only aimed at Chinese nationals but foreign residents.

Notice from the official website

© Image | chinatax.gov.cn

Tax Deductions for

6 Types of Expenses

Under the proposals, released by State Administration of Taxation on Saturday, people will be able to claim deductions for six types of expenses in addition to the existing ones for pension and insurance contributions, and the universal personal allowance of 5,000 yuan (US$720) a month.

Homeowners

From January 1, 2019 – assuming the new rules are approved – homeowners will be allowed to claim up to 1,000 yuan a month against mortgage interest payments on a first property.

Tenants

People who buy a house can enjoy deductions, and tenants are no exception. It should be pointed out that among the six special additional deductions, this is the only one that has regional differences, mainly in three categories.

-

In the municipalities and capital cities, the deduction standard is 14,400 yuan per year (1200 yuan per month);

-

Renting in other cities with a population of more than 1 million, the deduction standard is 12,000 yuan (1,000 yuan per month);

-

Renting in other cities with a population of no more than 1 million (inclusive), the deduction standard is 9,600 yuan per year (800 yuan per month).

Parents

Parents will be able to claim a 12,000 yuan tax deduction against the yearly cost of each of their children’s education expenses.

© Image | 视觉中国

Serious Illness Patients

People with “serious” illnesses will receive a 60,000 yuan a year tax allowance. The “serious” means that, in one year, the patient pay for the medical expenses of more than 15,000 yuan after deducting medical insurance allowance.

Carers

Those who care for elderly parents over 60 years old (including) will be entitled to tax relief on up to 2,000 yuan a month. The latter is a ceiling per parent, regardless of the number of carers involved.

© Image | 视觉中国

-

If the taxpayer is the only child, it shall be deducted according to the standard of 24,000 yuan per year (2000 yuan per month);

-

If the taxpayer is a non-only child, the child can share a deduction of 24,000 yuan (2,000 yuan per month).

Continuing Educators

The special additional deductions for continuing educators are mainly divided into two cases: continuing education for academic qualifications and continuing education for vocational qualifications of skilled personnel.

-

During the academic education period, it is deducted according to the annual amount of 4,800 yuan (400 yuan per month);

-

Continuing education for professional qualifications of skilled personnel or for professional qualifications of professional and technical personnel shall be deducted at a rate of 3,600 yuan per year in which the relevant certificates are obtained.

How to Calculate the

Tax Deduction?

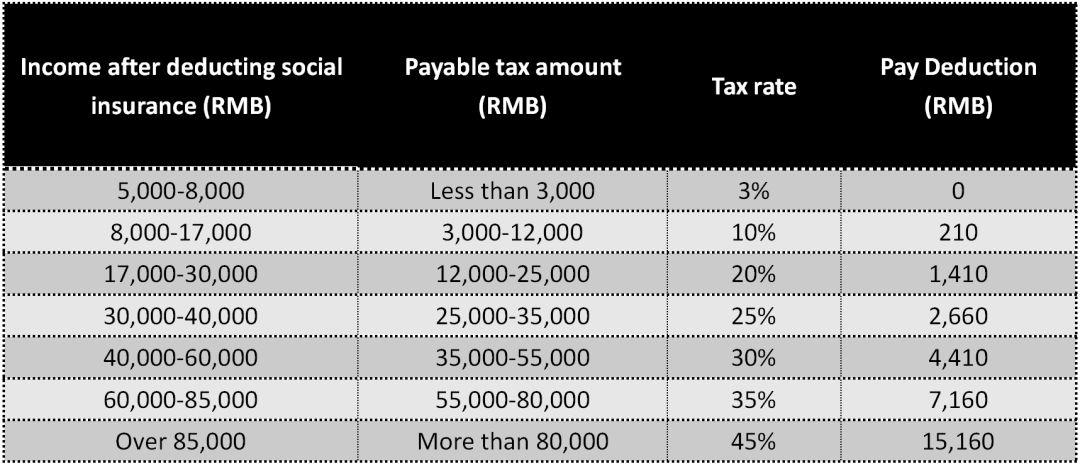

Taxable income = monthly income – 5000 yuan (threshold) – special deduction (social insurance, housing fund, etc.) – special additional deduction – other deductions determined according to law.

For Example

Mr. Liu, who works in Beijing, pays a monthly salary of 20,000 yuan after paying social insurance and housing fund. As the in-service graduate students, he has three expenses to clain the deductions, continuing education, renting, and supporting the elderly.

Tap to zoom in

Before the special additional deduction takes effect, the current tax payable is 1,590 yuan per month. After the implementation, Mr. Liu can also enjoy a special additional deduction of:

An Important Step for Chinese Tax System

Once approved, the new allowances will be added to the national tax law. They come after the government announced in August that the monthly personal tax allowance would be increased to 5,000 yuan from 3,500 yuan, and new tax bands would be introduced for low-income earners, effective October 1.

© Image | Chinadaily

This is the first time that China has introduced a special additional deduction concept in the tax system. It is also widely regarded as an important step in the implementation of the personal income tax system combining comprehensive and classified elements.

HACOS,Business Services Solutions Master