As is known to all, the CRS policy proposed by Organization for Economic Co-operation and Development ( OECD ).

众所周知,OECD(经合组织)提出的CRS政策。

© Image | Google

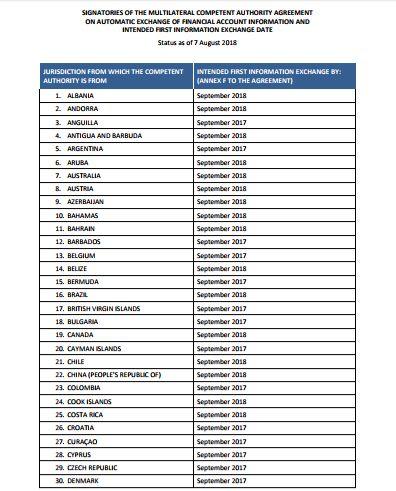

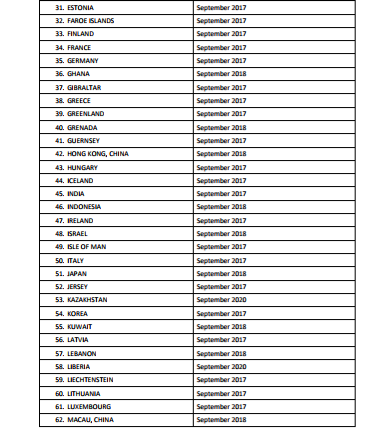

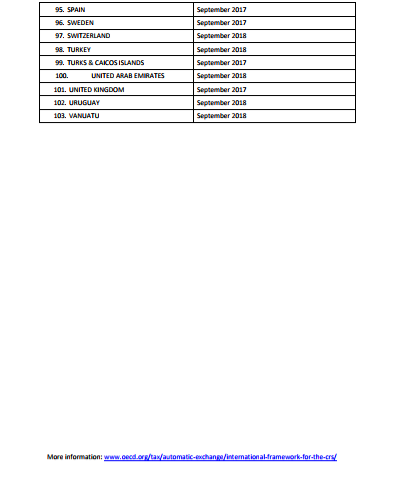

As of Aug 7, 2018, there are now already over 103 international countries (regional) have signed the “Multilateral Competent Authority Agreement on Automatic Exchange of Financial Account Information”, with next exchanges between these jurisdictions set to take place this Sep.

截至2018年8月7日,已经有103个国际(地区)签署了《金融账户涉税信息自动交换多边主管当局间协议》。

© Image | Google

China Mainland, Hong Kong, and Macau started the first information exchange this month, have you started to understand CRS yet?

中国内地、香港、澳门本月(2018年9月)开始首次信息互换了,您还没开始了解CRS吗?

CRS information exchange era

CRS信息互换时代

CRS (Common Reporting Standard), “Unified Reporting Standard” for the automatic exchange of tax information in financial accounts around the world, which aims to promote the Automatic Exchange of Tax Information between Countries, and is now gradually implement in various countries, it is expected to cover all member states completely in 2018.

CRS (Common Reporting Standard),及全球范围内金融账户涉税信息自动交换的“统一报告标准”,其本质主要就是反避税, 旨在推动国与国之间税务信息自动交换,目前正循序渐进地在各国实施,有望在2018年完全覆盖所有的成员国。

Information exchanged includes

CRS交换的的信息包括

-

Overseas institutional accounts: almost all overseas financial institutions, including banks, trusts, brokers, law firms, accounting firms, investment entities that provide various financial investment products, and specific insurance institutions.

-

海外机构账户:几乎所有的海外金融机构,包括银行、信托、券商、律所、会计师事务所、提供各种金融投资产品的投资实体、特定的保险机构等。

-

Asset information: deposit account, escrow account, cash-only fund or insurance contract, annuity contract.

-

资产信息:存款账户、托管账户、有现金的基金或者保险合同、年金合约。

-

Personal information: your account, account balance, name, date of birth, age, gender, place of residence.

-

个人信息:你的帐户、帐户余额、姓名、出生日期、年龄、性别、居住地。

© Image | Google

The jurisdictions that have exchanged information in 2017, including more than 50 Countries, involved 500,000 offshore assets being disclosed, Sweden recovering taxes of 3.3 billion euros, Australia recovering taxes of 4.59 billion Australian dollars, and France recovering taxes of 1.85 billion euros. Europe has generated an additional tax of 85 billion euros.

2017年已经进行信息交换的管辖区,包括50多个国家,涉及50万人离岸资产被披露,瑞典追回税收33亿欧元、澳洲追回税收45.9亿澳币、法国追回税收18.5亿欧元,欧洲总计产生额外税收850亿欧元。

What about CRS in China?

CRS来势汹汹,目前在中国进程如何?

On the one hand, China will complete the information exchange with the other jurisdictions participating in the CRS for the first time before Sep 30, 2018. In the following years, the information exchange between the jurisdictions will be carried out regularly.

2018年9月30日前,中国将与其他参与CRS的辖区完成首次辖区间的信息交换,以后年度也将每年定期进行辖区间的信息交换。

© Image | Google

On the other hand, China will complete the due diligence process for all stock clients and identify non-resident accounts before Dec 31, 2018.

2018年12月31日前,完成对所有存量客户的尽职调查程序,识别其中的非居民账户。

Who will be affected?

以下五类人将受到影响

Chinese, Overseas Bank Accounts have money

People in China, but some of the money in Overseas Financial Accounts such as Canada/Hong Kong (CRS signatory countries or regions), your financial information will be fed back to China. When it is officially implemented, it may be required to pay taxes.

Shareholder, the company has business Overseas

If you hold more than 25% of a company’s equity and the company has an Overseas Account at the CRS contract, the account details will be exchanged to China.

People who hold stocks overseas and buy insurance

Chinese people hold stocks of listed companies through overseas securities companies, or purchase valuable insurance or annuities overseas. These financial assets information will be reported to China, and the Chinese tax authorities will act as appropriate.

Foreigner, working in China and opening a bank account

Foreign individuals work in China and open a financial account. If the country where their nationality are located in also a CRS participating country, China will send his financial account information to his country.

Person who built an offshore family trust

If the trust is located in the CRS signing place, the information will be shared with China, such as the consignor, trustee, beneficiary of the overseas trust, and the Chinese who ultimately control the trust.

How to avoid the loss of your assets?

如何避免您的资产“裸奔”?

Recently, Boston Consulting Group (BCG) released the Global Wealth Management Report 2018 after investigating financial markets in 97 countries and regions around the world. According to the survey, there are about 8.2 trillion US dollars of offshore wealth in the world, and Hong Kong ranks second with 1.1 trillion US dollars.

近日,波士顿咨询(BCG)在调研了全球 97 个国家和地区的金融市场后,发布《全球财富管理报告 2018》。调研显示,全球约有 8.2 万亿美元离岸财富,香港以 1.1 万亿美元排第二。

In addition, according to an article by Bloomberg at the beginning of this year, China’s richest people hold about 5.3 trillion US dollars of assets, and more than half of the funds are stored Hong Kong.

另据彭博社在年初的一篇文章显示,中国富豪持有大约 5.3 万亿美元资产,过半资金存放在香港。

© Image | Baidu

-

If you hold more than 25% of the shares of a company other than your nationality, such as a Hong Kong company, please keep all business related invoices, bills of lading, receipt vouchers and other information, as well as make timely accounts every year, hire a professional Auditor to produce an Audit report, and submit these information to the Hong Kong Tax Bureau Office to complete the company’s tax declaration.

-

如您持有非您国籍所在地的公司股份25%以上,如香港公司,请保管好所有业务相关发票、提单、收据凭证等资料,每年及时做账,聘请专业的审计师制作审计报告,并提交至香港税局完成公司税务申报。

Notice!

注意!

Failure to submit an audit report on time will result in a fine or be summoned to the court, and severe cases will be blacklisted.

无法按时提交审计报告,会产生罚款或被传唤到法庭,严重者会被列入黑名单。

-

If you hold a private account that is not your nationality, please answer the call from the account manager in time and complete the declaration.

-

如您持有非您国籍所在地的私人账号,请及时接听回答客户经理的电话,完成各项申报。

-

If you are not sure whether you are affected or want to know more about proper handling, please contact our professional consultants and we will customize your personal solution.

-

如您不确认是否受影响或想了解更多妥善处理的方法,请联系我们的专业顾问,我们会为您定制个人解决方案。