Recently, many people have encountered a new type of fraud. Although nothing is done, no lost phone or lost card, no scanning suspected QR-code or clicking Trojan link, they will receive a lot of SMS from the bank and the money inside the card will be gone!

What’s worst? The online banking Apps login account and password have been tampered with and the losses will be very heavy.

Victim described the incident

Police Warns This Fraud via Weibo

© Image | Weibo

How did the fraud happen?

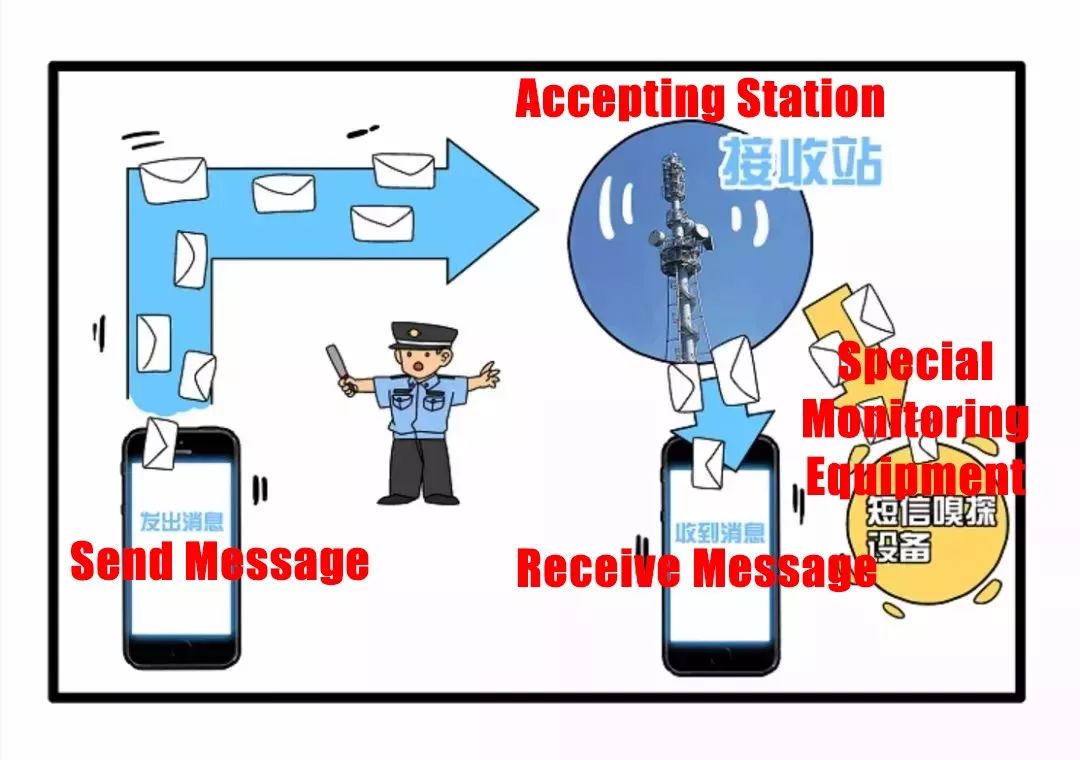

The scammer uses special devices to search automatically for nearby mobile numbers, logs in to some websites or Apps with your phone number, and then uses advanced technique to block the verification codes sent to you by these websites and Apps.

© Image | SinaNews

Step 2

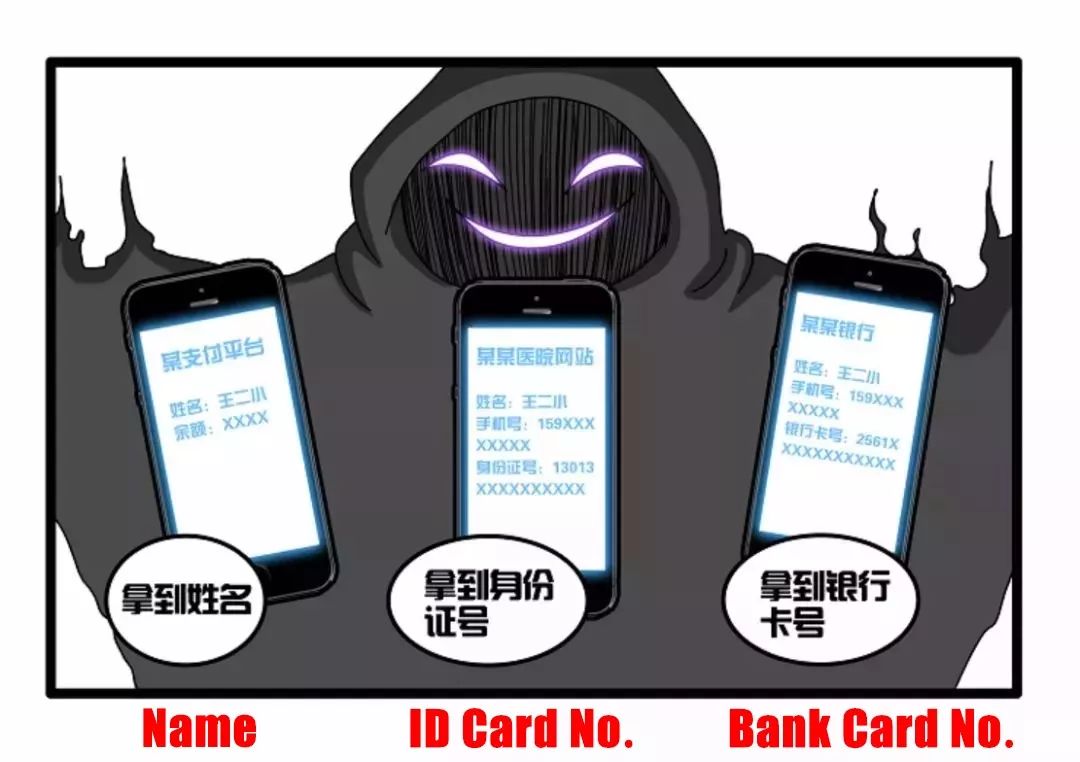

By logging in to other websites, the scammer will conjecture your identity information, including ID card/passport No., bank card No., mobile phone No., verification code and other information.

© Image | SinaNews

Step 3

The scammer opens an account on some other platforms and binds the owner’s bank card, pretending to be the owner to consume or cash out, thereby stealing the funds of the bank card. After that, you can only find a lot of verification codes in your phone and your savings have been stolen…

-

Originally, this technology is mainly for 2G GSM signals, but the trick is that they will interfere with nearby cell phone signals, so that 4G becomes a 2G signal and then steal your SMS verification message.

-

In addition, most of the gangs chose to commit crimes in the early morning, and they did not need to directly contact the victim. Therefore, most of the victims were unaware of theft of funds, and they only woke up with inexplicable verification codes on their mobile phones…

How to prevent this fraud?

The method of using such a new type of pseudo base station fraud is to exploit the loophole of the mobile phone signal protocol, which is basically unpreventable for ordinary users, and also brings great challenges to the police’s detection work!

However, most of the current payment or bank app require both SMS verification code and other multiple verifications, such as picture verification, voice verification, face verification, fingerprint verification and so on.

© Image | 广州日报

So you don’t have to worry too much! Due to technical limitations, too many mobile phone numbers cannot be detected at the moment.

You can pay attention to

these points at ordinary times.

-

It is necessary to protect sensitive personal information such as mobile phone No., ID card/passport No., bank card No., and payment platform account No.

-

Turn off the phone before going to bed or set the flight mode, or turn off the Cellular Data in your phone, only connect WIFI, which can slightly improve the difficulty of being detected.

-

If you suddenly receive a strange verification code message in the middle of the night, PLEASE check your bank card and payment Apps. At this time, if the money is found to have been stolen, PLEASE frozen your bank card ASAP. You also need to keep the content of the message and call the police.

-

If you suddenly find that the mobile phone signal becomes 2G, immediately realize that you may be experiencing this kind of attack and take the above defense!

Share to let your friends know!